AI Judgment Infrastructure™

Judgment Infrastructure

for Capital Allocation

AI for VC due diligence that checks business physics, not narrative polish. Upload a deck, get a forensic verdict in 3 minutes.

3,000+

Outcome Patterns

40+

Forensic Dimensions

Real-time

Analysis Speed

Zero

Data Retention

Choose Your Interface.

Two venture capital AI tools. One judgment layer.

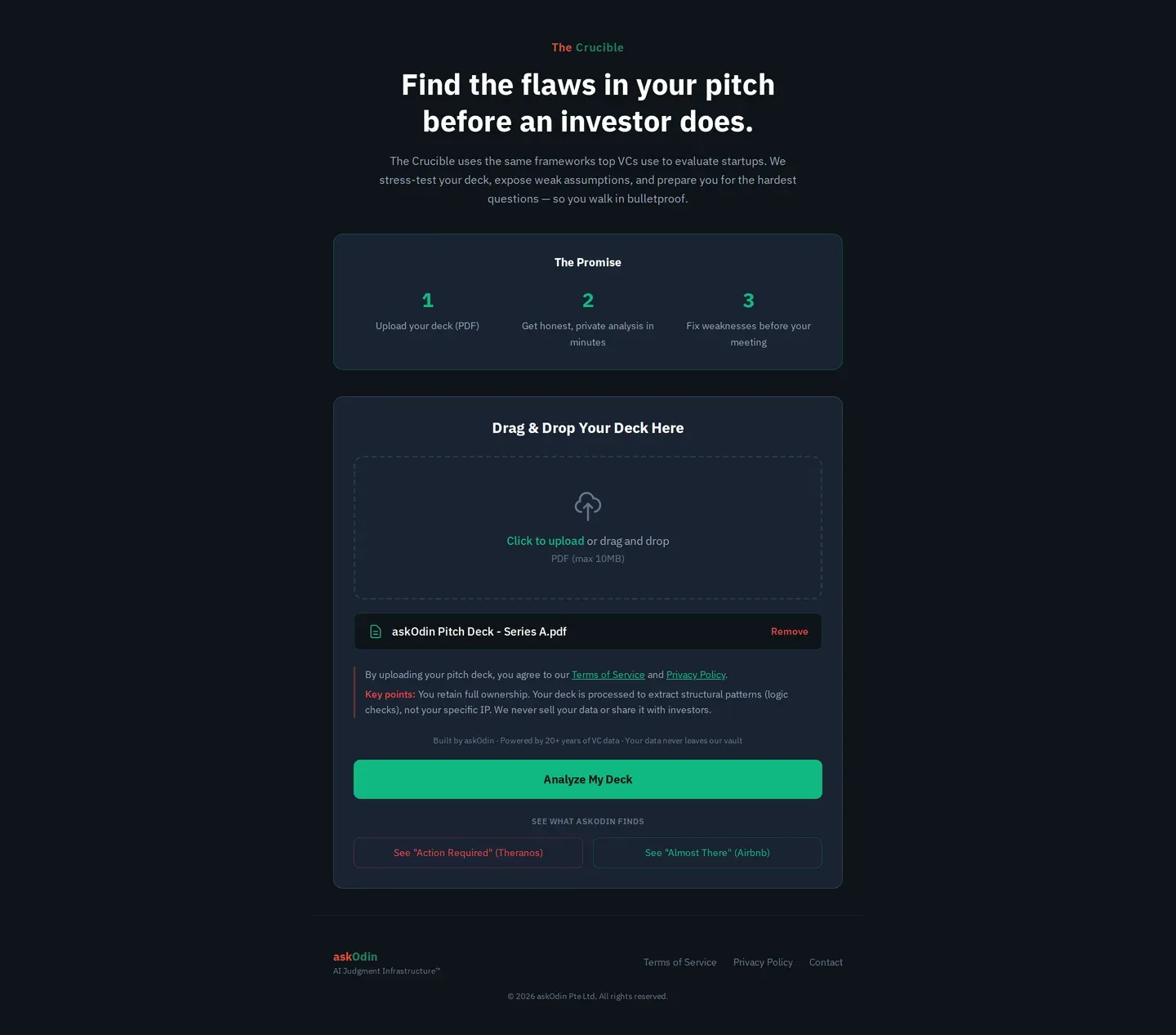

The Crucible

FREEStress-test your narrative before the meeting.

Upload your pitch deck. Get a forensic report with your Clarity Score, brittle assumptions, and the investor questions you're not ready for. Fix. Re-upload. Score higher.

Stress-Test My Deck

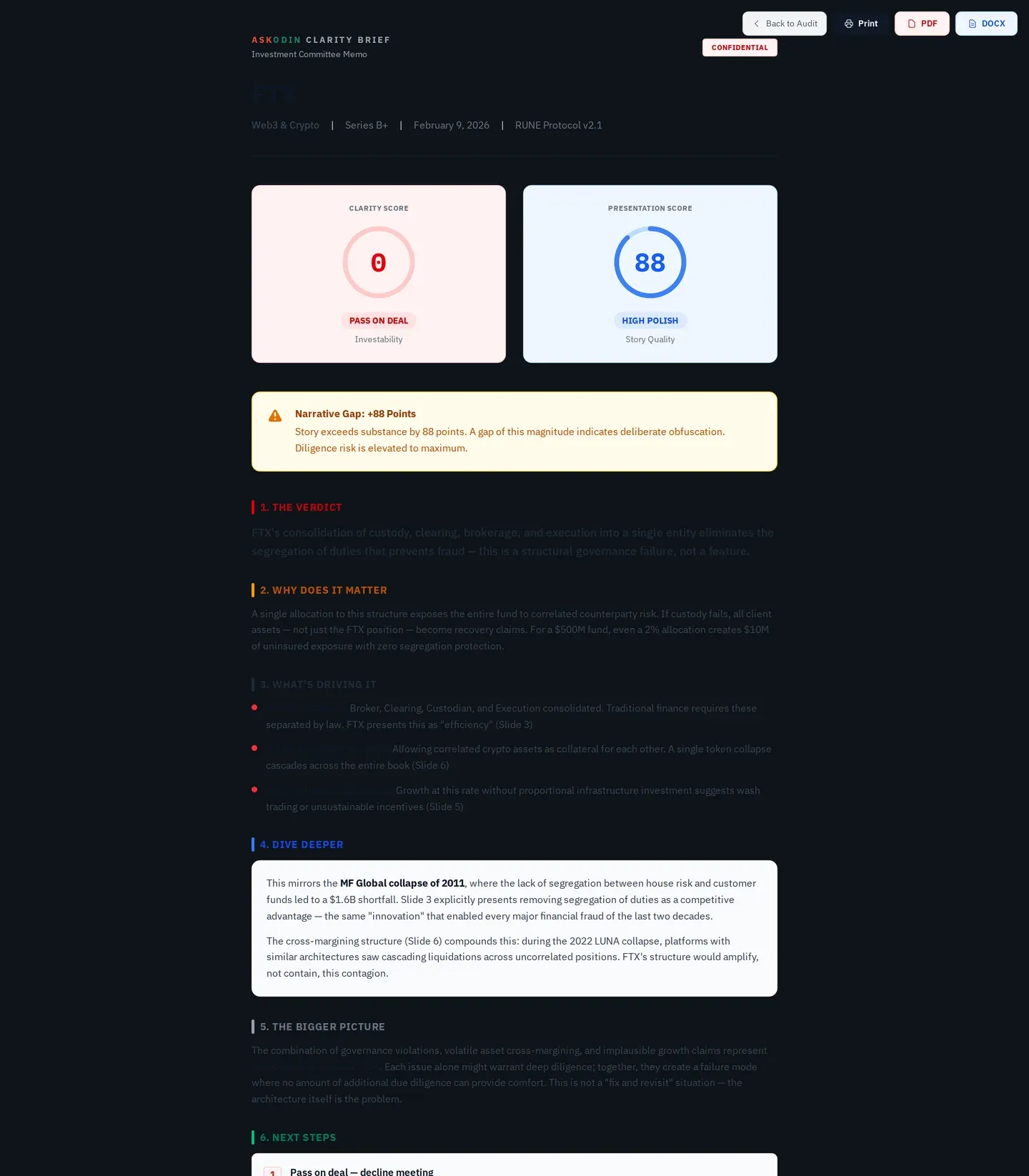

Clarity

ENTERPRISEFilter noise and detect fraud at scale.

Pipeline triage, cross-document forensic audit, cohort analysis, and IC-ready memos. Your analysts get the forensic capability of a GP. Every deal scored in minutes.

Request Demo

Forensic Logic in Action.

Ingest → Score → Kill Shot. Three steps. Real screenshots.

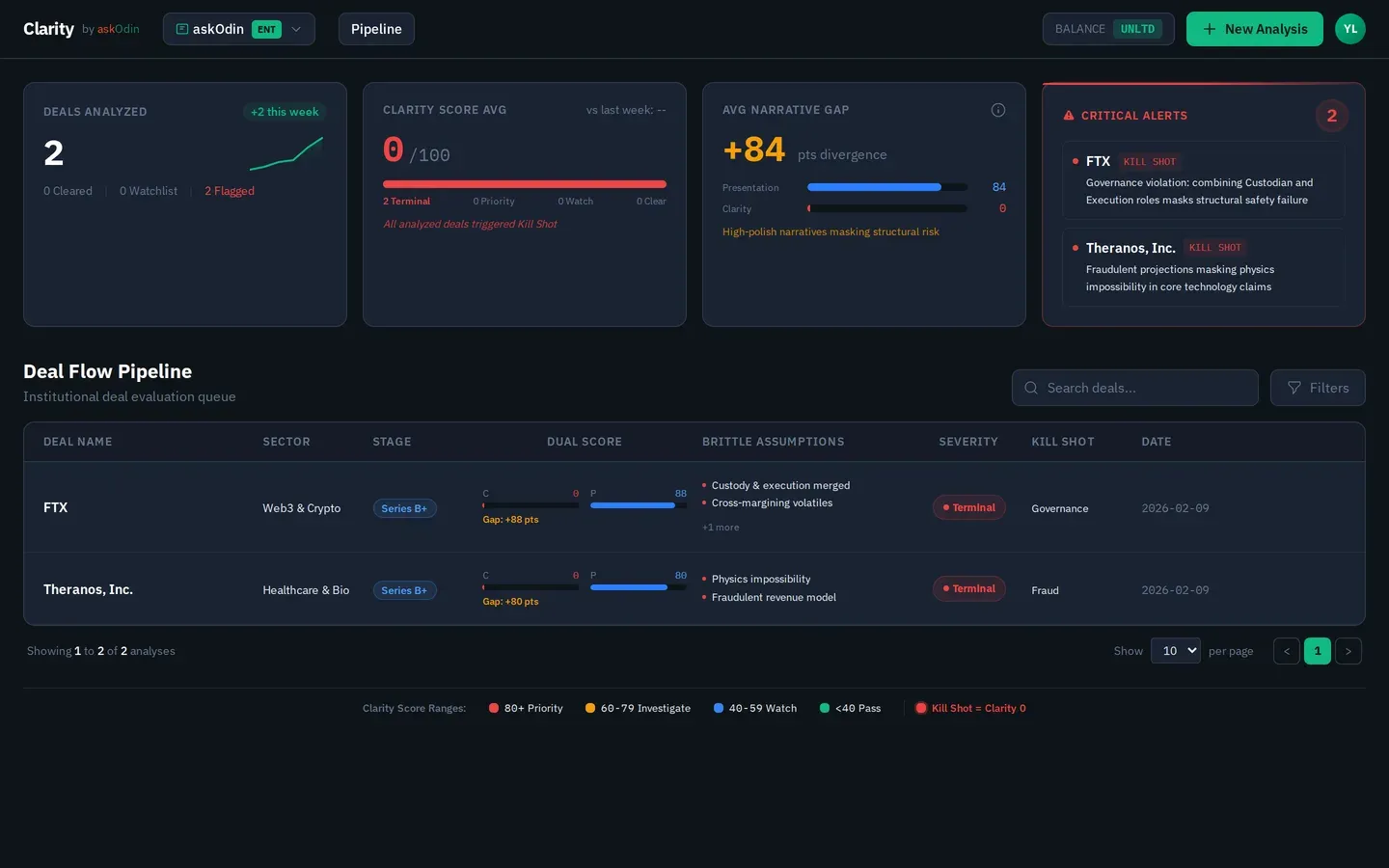

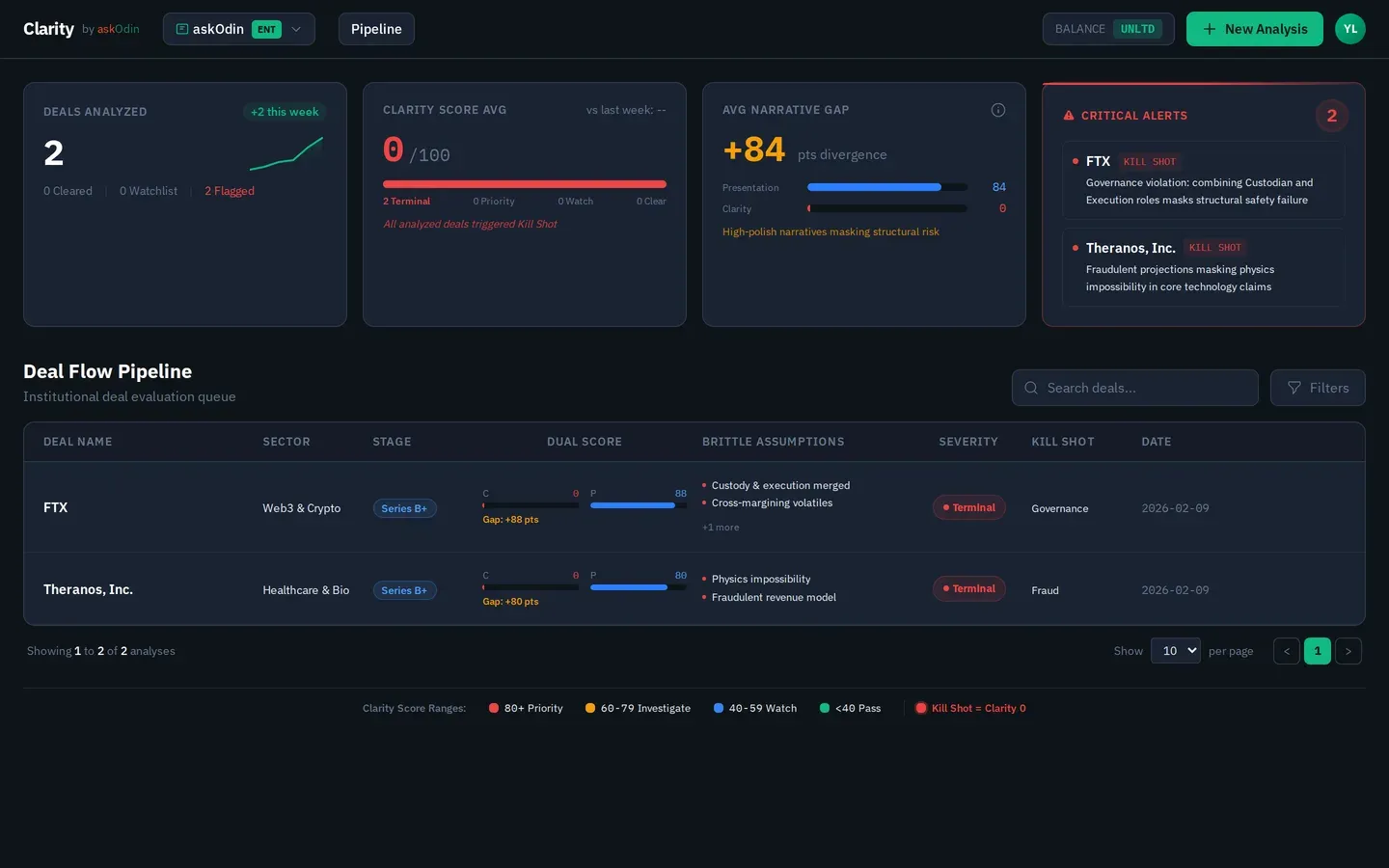

Pipeline Dashboard

Every deal scored. Kill Shots flagged.

Dual Score Protocol separates narrative polish from business physics. Terminal failures auto-flagged before the first meeting.

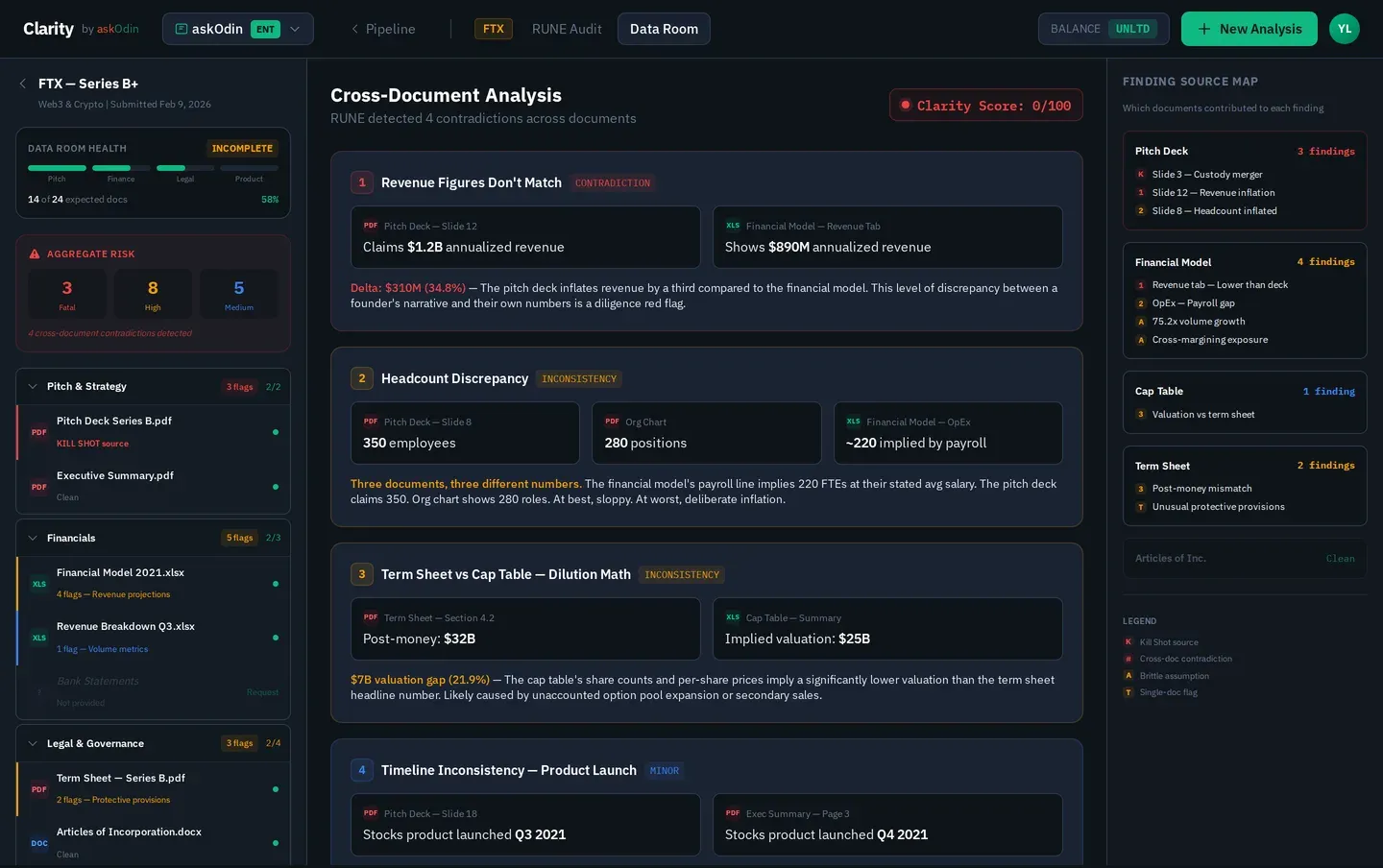

Forensic Audit

Cross-document contradiction detection.

Revenue in the deck doesn't match the financial model? Flagged automatically. Three docs, three different headcounts? Terminal failure.

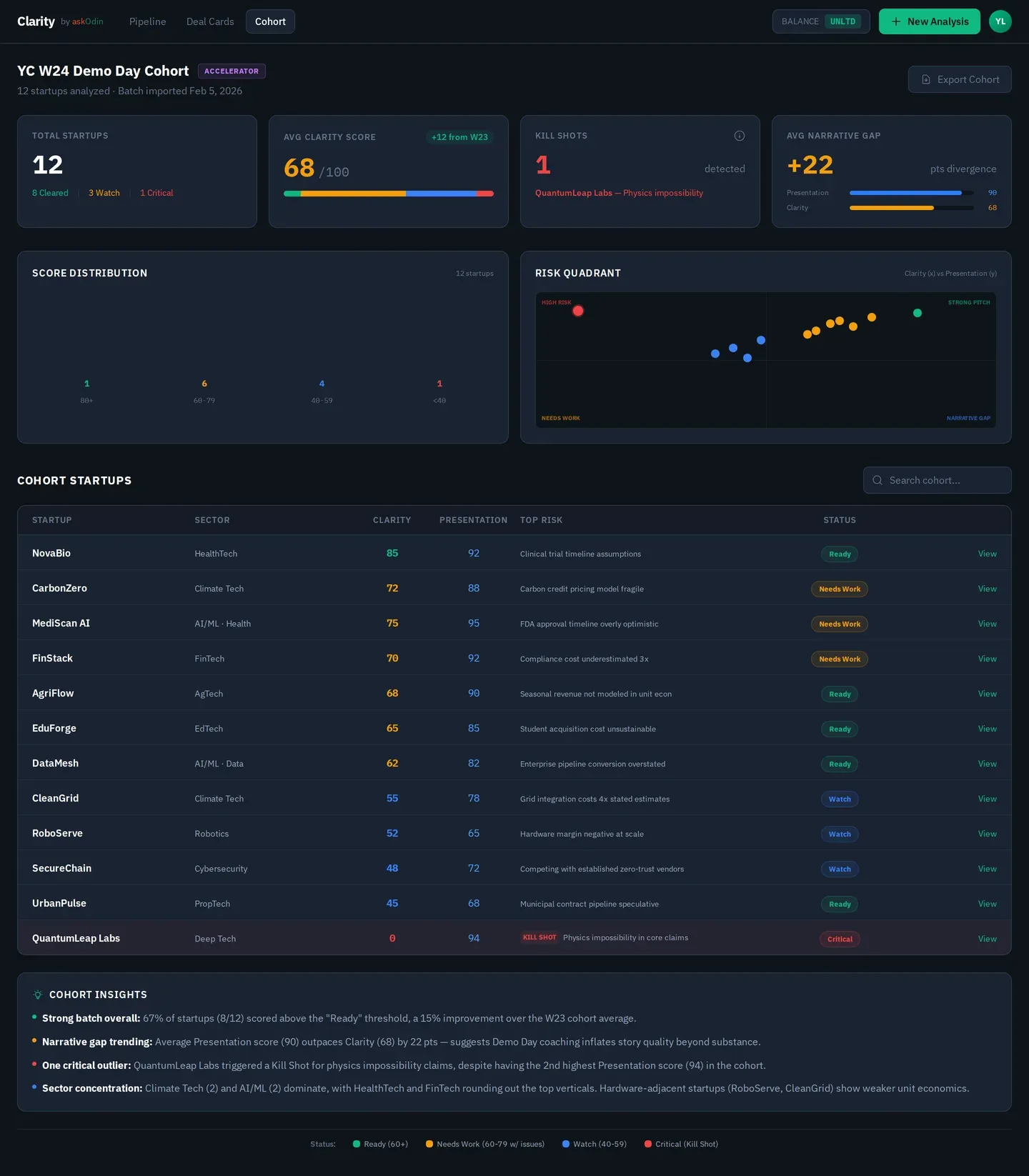

Cohort Analysis & IC Memos

Batch triage. IC-ready output.

Accelerators: score an entire batch in minutes. VCs: auto-generate investment memos with evidence-backed recommendations. Export as .docx or .pdf.

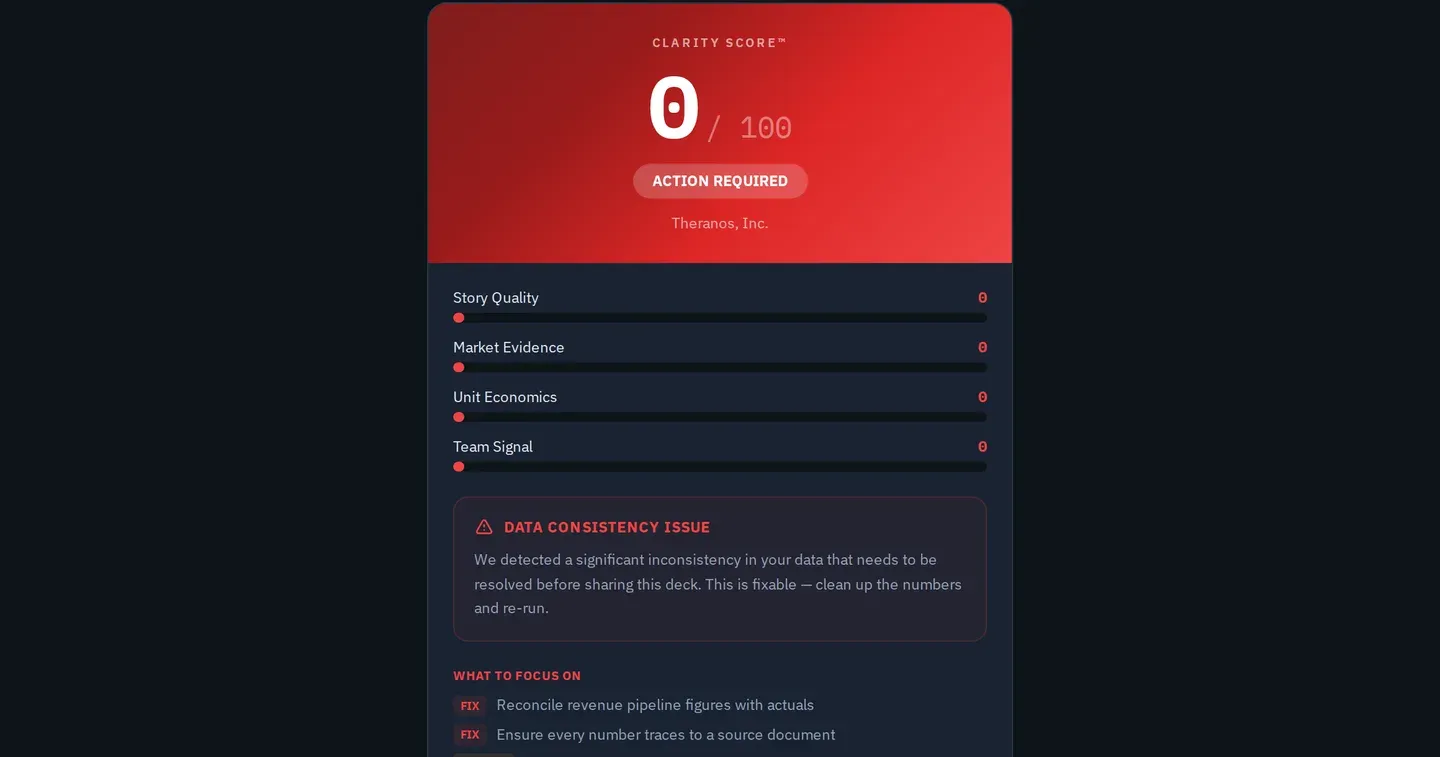

One Framework. Three Verdicts.

Theranos scores 0 despite a compelling story. That's the point.

Theranos · 0

Kill Shot. Data contradiction. Score collapsed.

Airbnb · 65

Strong narrative. 3 brittle assumptions to fix.

askOdin · 78

Category creator detected. Fine-tune TAM math.

We Check Physics, Not Grammar.

Every Clarity Score is computed across four dimensions. Every finding is traceable to source.

Powered by the Clarity Framework™

Story

Quality

Logical consistency between claims. Does Slide 8 contradict Slide 12?

Market

Evidence

Data provenance. Verified metrics vs. unsupported assertions masquerading as facts.

Unit

Economics

Financial viability. Does the math work at scale, or does it defy economic gravity?

Team

Signal

Execution capability. Domain-specific scar tissue and track record assessment.

Built on the RUNE Protocol™

Frequently Asked Questions

What is askOdin?

What is the Clarity Score?

What is the Audit Gap in venture capital?

What is Kill Shot detection?

How does askOdin differ from ChatGPT?

Stop Guessing. Start Auditing.

Whether you're building the next great company or allocating the capital to fund it.

U.S. Provisional Patent No. 63/948,559